India's Top 10 Fintech Startups

Description

Fintech has exploded in India over the course of the last few years, and this dramatic rise in popularity is something that Indian entrepreneurs have been quick to capitalise on. In this video, we'll be telling you about India's top 10 fintech startups, and what they've been able to accomplish so far.

#10 Zerodha: Bangalore-based Zerodha was started as an online brokerage platform by two brothers, Nithin Kamath, and Nikhil Kamath, in 2010. Today, Nithin Kamath and Nikhil Kamath have managed to acquire 1.5 million clients to use their platform, making Zerodha one of the biggest brokers in India. What is more, Nithin Kamath and Nikhil Kamath have made the startup profitable and bootstrapped.

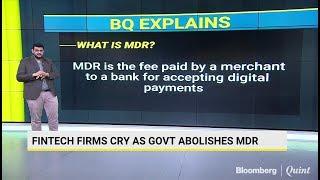

#9 Razorpay: Razorpay was founded by Harshil Mathur and Shashank Kumar in 2014. Bored with their jobs, both Harshil Mathur and Shashank Kumar quit and started building Razorpay from Harshil’s parent’s house in Jaipur. Today, Harshil Mathur and Shashank Kumar have managed to build Razorpay into a comprehensive end-to-end digital payments solution. A large part of this growth can be attributed to the support they have received from their investors, who have invested nearly $125 million.

#8 Capital Float: Capital Float was founded by Gaurav Hinduja and Shashank Rishyasringa in 2013. Capital Float partners with banks and NBFCs to offer easy access to working capital to Indian SMEs. Due to the fact that there are about 30 million SMEs in India, Gaurav Hinduja and Shashank Rishyasringa are solving a huge problem. Thanks to Gaurav Hinduja and Shashank Rishyasringa, Capital Float has managed to disburse more than $1 billion in loans to over 47,000 customers. The fintech startup has raised nearly $145 million from its investors.

#7 Acko: This fintech startup was founded by Varun Dua in 2017, and is a digital platform that offers its customers insurance for vehicles, smartphones, and travels. Before founding Acko, Varun Dua also founded Coverfox in 2013. Under the leadership of Varun Dua, Acko insures more than 45 million customers. The startup has also raised $143 million from its investors.

#6 CRED: This fintech startup was founded Kunal Shah in 2018, and is a platform that offers exclusive rewards, experiences, and upgrades to its users for timely payment of their credit card bills. Before CRED, Kunal Shah also founded Freecharge in 2010. Unlike other entrepreneurs, who believe in trying out an idea and pivoting, Kunal Shah believes in extensive research before moving forward with an idea. CRED has managed to secure investment totaling $175 million.

#5 Lendingkart: Founded by Harshvardhan Lunia and Mukul Sachan in 2014, Lendingkart provides unsecured loans to SMEs in India. Harshvardhan Lunia and Mukul Sachan have ensured that their platform is accessible to people who don't speak English, by providing it in five regional languages apart from English. So far, the startup has disbursed loans to over 73,000 businesses, and Harshvardhan Lunia and Mukul Sachan couldn't be happier. So far, Lendingkart has successfully raised $200 million.

#4 Pine Labs: Rajul Garg and Tarun Upaday founded Pine Labs in 1998, and it took the startup 22 years to become a unicorn. However, neither Rajul Garg and Tarun Upaday got to experience this milestone, as both left the company in 2004. Today, Pine Labs processes payments worth $30 billion every year through its network of 140,000 merchants across 3,700 cities in India, Southeast Asia and the Middle East.

#3 PolicyBazaar: PolicyBazaar is India’s largest online insurance aggregator, and was founded by Yashish Dahiya, Alok Bansal, and Avaneesh Nirjar in 2008. Yashish Dahiya came up with the idea for PolicyBazaar when he realized that his father had been cheated by a policy agent. With his father's financial struggles as a key motivator, Yashish Dahiya made PolicyBazaar into what it is today: a fintech startup that sells 400,000 policies every month, while growing at the rate of 100% year-on-year, and having raised $500 million in funds so far.

#2 PhonePe: Sameer Nigam and Rahul Chari founded PhonePe in 2015, and the mobile payments startup was acquired by Flipkart in April 2016, bringing Sameer Nigam and Rahul Chari back into Flipkart, where they used to work. PhonePe has come a long way since the day Sameer Nigam and Rahul Chari wrote the first lines of code back in 2015: today, more than 5 million merchants are using PhonePe to accept payments, and the app crossed 5 billion transactions in December 2019.

#1 Paytm: Vijay Shekhar Sharma started Paytm, India's most valuable unicorn, in 2010. What is more, Vijay Shekhar Sharma started Paytm's parent company One97 back in 2000, and had to convince the board of directors at that company that Paytm was worth creating. Today, this gamble has paid off for Vijay Shekhar Sharma, as Paytm has over 350 million users and has raised $4.4 billion to date.

#fintech #backstagewithmillionaires #bwm

Comments