Jim Cramer: The looming market sell-off is 'a terrible thing to waste' for investors

Description

"So many companies [are] doing so well. I'd love to buy them, but at this point only on weakness," "Mad Money" host Jim Cramer said.

Investors got spooked and Wall Street coughed up its gains after word spread that import tariffs could stay in place after a U.S.-China trade agreement is signed Wednesday, CNBC’s Jim Cramer said Tuesday.

The Dow Jones Industrial Average rose almost 150 points to its early afternoon highs before closing the session up roughly 32 points. The S&P 500 and Nasdaq Composite both reached new heights during the trading day before finishing down about 0.20%.

“If today’s afternoon pullback turns into a full-blown decline later this week, you need to remember that a sell-off would be a terrible thing to waste,” the “Mad Money” host said. “So many companies [are] doing so well. I’d love to buy them, but at this point only on weakness.”

After trading at new highs, the market fell following the news that the rollback of tariffs on Chinese imports would be delayed until Washington and Beijing come to terms on a phase two trade deal. People began worrying about the uncertain path to reach another agreement. The two countries are preparing to sign a long-awaited, so-called phase one trade deal in Washington, D.C., on Wednesday.

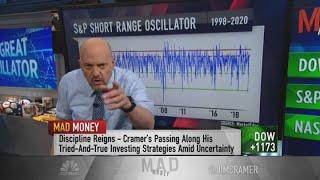

Investors are still waiting to hear the full details of the trade deal, but the latest development is one that Cramer, who has been supportive of President Donald Trump’s trade war, approves of. He added that the market “had gotten overbought,” which contributed to the late Tuesday slide.

He said: “I think leaving the tariffs on until China actually follows through with its promises — since they’ve double-crossed us so many times — makes a ton of sense. It should have caused a rally, not a sell-off.”

Outside of trade chatter, Cramer pointed to “astonishing” quarterly reports from Delta Air Lines, Citigroup and J.P. Morgan Chase. The two bank stocks closed up more than 1% as the airliner’s stock rose 3.3% on the day.

J.P. Morgan, buoyed by its performance in bond trading, reported earnings of $2.57 a share, and Citigroup, also powered by its bond trading and consumer businesses, showed earnings of $1.90 per share. Delta posted $1.70 in adjusted earnings per share, benefiting from lower fuel prices and strong travel demand in its latest quarter.

Wells Fargo was the “one fly in the ointment,” Cramer said. The embattled bank, now led by CEO Charles Scharf, saw legal fees eat away at its pocket while low interest rates negatively impacted business. The bank missed on both the top and bottom lines.

Though the market is overheated, Cramer said the banks showed some positive signs about the consumer.

“The statistics from these banks show a robust consumer who’s still spending within her means,” the host said. “That’s an encouraging backdrop, especially if we’re headed into some short-term sell-off after a remarkable run.”

For access to live and exclusive video from CNBC subscribe to CNBC PRO: https://www.cnbc.com/pro/?__source=youtube

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC Classic: https://cnb.cx/SubscribeCNBCclassic

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/

Follow CNBC on LinkedIn: https://cnb.cx/LinkedInCNBC

Follow CNBC News on Facebook: https://cnb.cx/LikeCNBC

Follow CNBC News on Twitter: https://cnb.cx/FollowCNBC

Follow CNBC News on Instagram: https://cnb.cx/InstagramCNBC

#CNBC

#CNBC TV

Comments