Trump Slams Federal Reserve After It Cut Rates by Half a Point Amid Coronavirus Spread

Description

Speaking to reporters on the South Lawn of the White House, President Trump criticized the Federal Reserve, even though it swooped into the market with an emergency interest-rate cut in hopes of shielding the economy from the effects of the fast-spreading virus.

"The Fed is very disappointing to me. They have to lead, not follow. They are following, not leading," he said.

The Federal Reserve slashed interest rates by half a percentage point in the first such emergency move since the 2008 financial crisis, amid mounting concern that the coronavirus outbreak threatens to stall the record U.S. economic expansion.

The rate cut, which came between the central bank’s regularly scheduled meetings, was announced hours after Group of Seven finance chiefs held a rare teleconference to pledge they’d do all they can to combat the fast-moving health crisis.

“My colleagues and I took this action to help the U.S. economy keep strong in the face of new risks to the economic outlook,” Fed Chairman Jerome Powell told a hastily convened press conference in Washington on Tuesday. “The spread of the coronavirus has brought new challenges and risks.”

Investors weren’t impressed by either the G-7 promise or the Fed’s move. After rallying earlier in the week on anticipation of action, the S&P 500 index fell more than 3% while the 10-year Treasury yield plunged below 1%. Traders are betting that the Fed will have to do more, with the futures markets pricing additional easing later this year.

Powell left the door open to further action by the central bank at its next scheduled meeting March 17-18. “In the weeks and months ahead we will continue to closely monitor developments,” he said.

The Fed chief acknowledged that the Fed doesn’t have all the answers, adding that it would take a multi-faceted response from governments, health care professionals, central bankers and others to stem the human and economic damage.

“We do recognize a rate cut will not reduce the rate of infection, it won’t fix a broken supply chain. We get that,” Powell said. “But we do believe that our action will provide a meaningful boost to the economy.”

The vote for the rate cut to a range of 1% to 1.25% was unanimous even though the Fed said in a statement that the “fundamentals of the U.S. economy remain strong.” Powell has staked his chairmanship on sustaining the U.S. economic expansion, now in its record 11th year.

“The Fed has very little ammunition and the ammunition that it does have is not at all suited to the task of managing a potentially large adverse supply shock,” said Jonathan Wright, economics professor at Johns Hopkins University and a former Fed economist. “They have taken the view that they should do what they can with the tools that they have.”

The Fed’s decision could presage a wave of easing from other central banks around the world although those in the euro-area and Japan have less scope to follow with rates already in negative territory.

The Fed move also followed public pressure for a cut by President Donald Trump, whose stewardship of the economy is central to his reelection campaign this year.

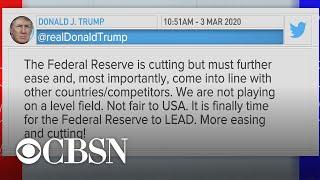

After today’s shift he called for more, demanding in a tweet that the Fed “must further ease and, most importantly, come into line with other countries/competitors. We are not playing on a level field. Not fair to USA.”

Subscribe to our YouTube channel: https://bit.ly/2TwO8Gm

QUICKTAKE ON SOCIAL:

Follow QuickTake on Twitter: twitter.com/quicktake

Like QuickTake on Facebook: facebook.com/quicktake

Follow QuickTake on Instagram: instagram.com/quicktake

Subscribe to our newsletter: https://bit.ly/2FJ0oQZ

Email us at [email protected]

QuickTake by Bloomberg is a global news network delivering up-to-the-minute analysis on the biggest news, trends and ideas for a new generation of leaders.

Comments