Former Federal Reserve vice chair Alan Blinder puts recession odds at 90 percent

Description

CNBC's "Squawk Alley" team discusses market volatility and the outlook for the U.S. economy with Alan Blinder, former Federal Reserve vice chair.

The Federal Reserve is again increasing the amount of money it’s providing to banks for overnight borrowing, raising the top level now to $175 billion.

In an announcement Wednesday afternoon, the New York Fed said it would boost the top level it provides in overnight operations to at least $175 billion from the $150 billion level it had just set Monday.

“Consistent with the FOMC directive to the Desk, these operations are intended to ensure that the supply of reserves remains ample and to mitigate the risk of money market pressures that could adversely affect policy implementation,” the Fed’s statement read. “They should help support smooth functioning of funding markets as market participants implement business resiliency plans in response to the coronavirus.”

In addition to the overnight facility, the Fed is extending its two-week repo of at least $45 billion, and is adding a one-month term repo of at least $50 billion. The latter move comes amid market demand for a longer-term commitment from the Fed amid market disruptions, tumbling Treasury yields and concerns over market functioning.

The new operations will start Thursday and continue through April 13. The one-month term operations will happen each of the next three Thursdays.

“The Fed has finally made a serious play to improve dysfunctional market conditions and address funding pressures by providing term liquidity on a substantial scale,” Krishna Guha, head of the global policy and central bank strategy team at Evercore ISI, said in a note. “This is all very welcome if overdue. We are not sure that it will prove to be enough.”

The Fed began conducting its repo operations following market tumult in September that arose from a lack of liquidity and concerns over the proper level of reserves for the banking industry. Banks go to the repo market for the short-term funding seen as the plumbing for the industry. Institutions offer high-quality collateral in exchange for reserves.

Since the operations began, and when the Fed began adding to its own bond holdings by purchasing $60 billion a month in short-term Treasury bills, the central bank’s balance sheet has expanded by $472 billion to nearly $4.3 trillion. Bank reserves parked at the Fed now stand at $1.64 trillion after falling last year below $1.5 trillion, a level central bankers now consider important.

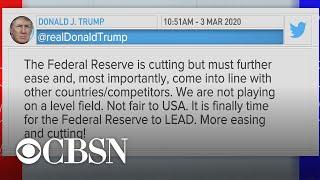

Markets expect still more Fed action in the form of a 75 basis point interest rate cut by next week’s Federal Open Market Committee meeting, if not sooner. There also is a further 25 basis point cut priced in for the April meeting, which would take the fed funds rate, used as a yardstick for short-term borrowing rates as well as for many types of consumer debt, down to near-zero, where it fell during the financial crisis and remained for seven years.

For access to live and exclusive video from CNBC subscribe to CNBC PRO: https://www.cnbc.com/pro/?__source=youtube

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC Classic: https://cnb.cx/SubscribeCNBCclassic

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/

Follow CNBC on LinkedIn: https://cnb.cx/LinkedInCNBC

Follow CNBC News on Facebook: https://cnb.cx/LikeCNBC

Follow CNBC News on Twitter: https://cnb.cx/FollowCNBC

Follow CNBC News on Instagram: https://cnb.cx/InstagramCNBC

#CNBC

#CNBC TV

![⚠️ BREAKING NEWS: The Federal Reserve Ready to Announce EMERGENCY Rate Cuts [BE READY]](https://no-mar.com/uploads/thumbs/e216d2263-1.jpg)

Comments